From Bloomberg:”

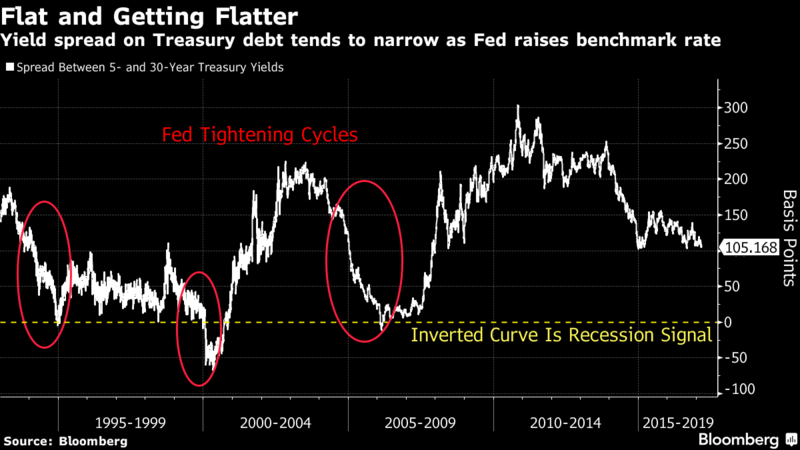

Tightening cycles have historically spurred outperformance in long-maturity debt, and managers of more than $1 trillion of fixed-income assets say this time’s no different. That confidence flies in the face of projections that the government’s debt burden will balloon by $10 trillion in the next decade, even before taking into account Trump administration plans to jumpstart the economy.

In the $13.9 trillion Treasuries market, signs abound that holders of longer-dated obligations see little risk of a substantial acceleration in growth and inflation: The term premium on 10-year notes dipped below zero last month for the first time since November; traders are paying just as much to protect against inflation over the next few years as a decade out; and there’s unprecedented demand for strips, one of the most bullish bets in the bond market.

“We don’t necessarily think this is going to be a major trend change, and that we have a longer-term break out of the downtrend in yields,” said Steve Bartolini, portfolio manager of inflation-focused strategies at T. Rowe Price Group, which oversees $188 billion of fixed-income. If benchmark 10-year Treasury yields climb to 2.75 percent or 3 percent, “those are levels we would consider adding to duration.”

“;

More at Bloomberg: https://www.bloomberg.com/politics/articles/2017-03-12/bond-traders-mantra-is-don-t-fret-the-fed-as-rate-hikes-ramp-up